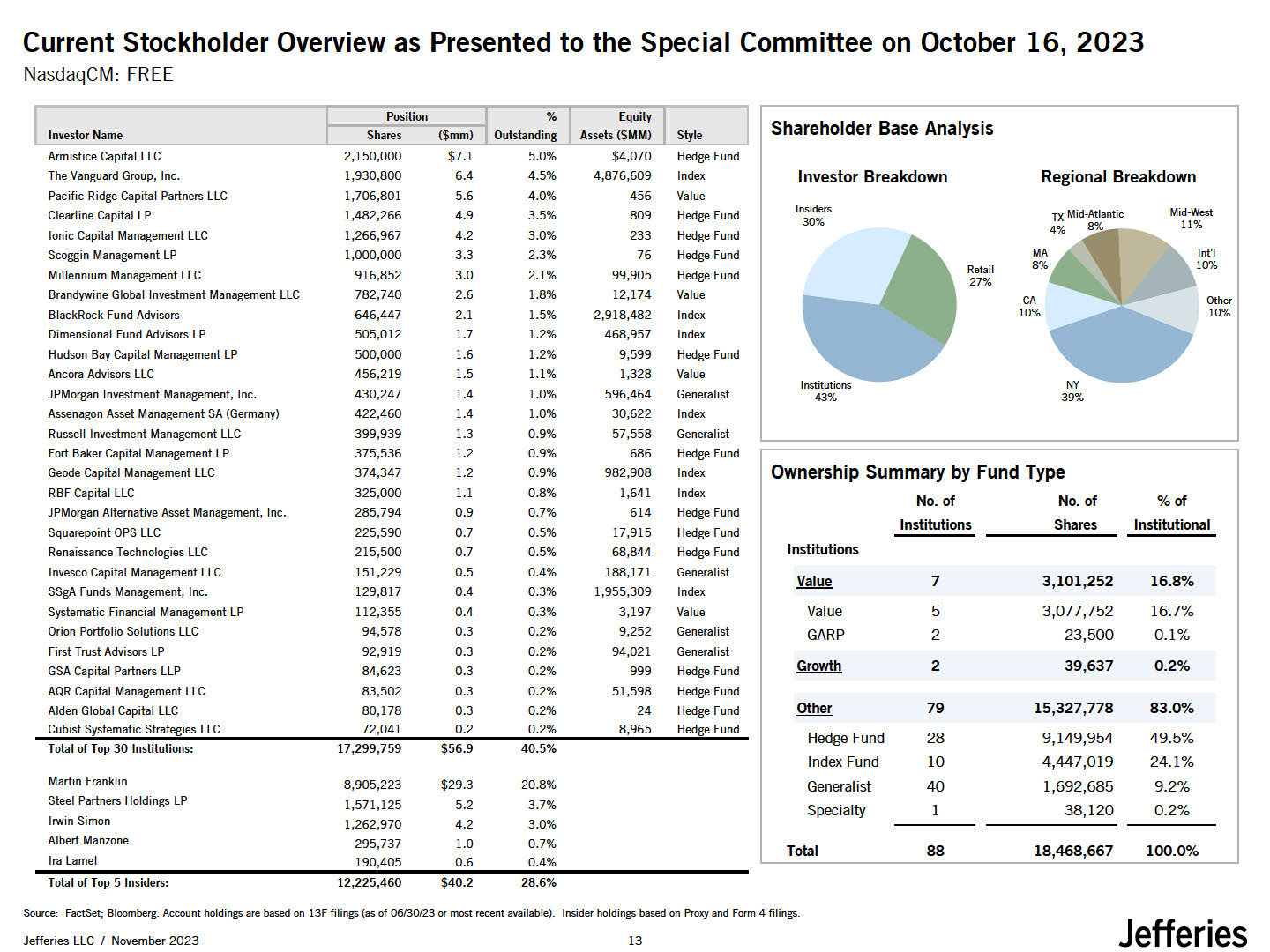

Investor Name Position Shares ($mm) % Outstanding Equity Assets

($MM) Style Shareholder Base Analysis Armistice Capital LLC 2,150,000 $7.1 5.0% $4,070 Hedge Fund Investor Breakdown Regional Breakdown Insiders Mid-West 30% 11% MA lnt'I Retail 8% 10% 27% CA Other 10% 10% Institutions 43% The

Vanguard Group, Inc. 1,930,800 6.4 4.5% 4,876,609 Index Pacific Ridge Capital Partners LLC 1,706,801 5.6 4.0% 456 Value Clearline Capital LP 1,482,266 4.9 3.5% 809 Hedge Fund Ionic Capital Management

LLC 1,266,967 4.2 3.0% 233 Hedge Fund Scoggin Management LP 1,000,000 3.3 2.3% 76 Hedge Fund Millennium Management LLC 916,852 3.0 2.1% 99,905 Hedge Fund Brandywine Global Investment Management

LLC 782,740 2.6 1.8% 12,174 Value BlackRock Fund Advisors 646,447 2.1 1.5% 2,918,482 Index Dimensional Fund Advisors LP 505,012 1.7 1.2% 468,957 Index Hudson Bay Capital Management LP 500,000 1.6 1.2% 9,599 Hedge

Fund Ancora Advisors LLC 456,219 1.5 1.1% 1,328 Value JPMorgan Investment Management, Inc. 430,247 1.4 1.0% 596,464 Generalist Assenagon Asset Management SA (Germany) 422,460 1.4 1.0% 30,622 Index Russell Investment Management

LLC 399,939 1.3 0.9% 57,558 Generalist Fort Baker Capital Management LP 375,536 1.2 0.9% 686 Hedge Fund Ownership Summaryby Fund Type No. of No. of %of Institutions Shares Institutional Geode Capital Management

LLC 374,347 1.2 0.9% 982,908 Index RBF Capital LLC 325,000 1.1 0.8% 1,641 Index JPMorgan Alternative Asset Management, Inc. 285,794 0.9 0.7% 614 Hedge Fund Squarepoint OPS LLC 225,590 0.7 0.5% 17,915 Hedge Fund Renaissance

Technologies LLC 215,500 0.7 0.5% 68,844 Hedge Fund Institutions Value Value GARP Growth other Hedge Fund Index Fund Generalist Specialty Total 7 3,101,252 16.8% 5 3,077,752 16.7% 2 23,500 0.1% 2 39,637 0.2% 79 15,327,778

83.0% 28 9,149,954 49.5% 10 4,447,019 24.1% 40 1,692,685 9.2% 1 38,120 0.2% 88 18,468,667 100.0% Invesco Capital Management LLC 151,229 0.5 0.4% 188,171 Generalist SSgA Funds Management,

Inc. 129,817 0.4 0.3% 1,955,309 Index Systematic Financial Management LP 112,355 0.4 0.3% 3,197 Value Orion Portfolio Solutions LLC 94,578 0.3 0.2% 9,252 Generalist First Trust Advisors

LP 92,919 0.3 0.2% 94,021 Generalist GSA Capital Partners LLP 84,623 0.3 0.2% 999 Hedge Fund AQR Capital Management LLC 83,502 0.3 0.2% 51,598 Hedge Fund Alden Global Capital LLC 80,178 0.3 0.2% 24 Hedge Fund Cubist

Systematic Strategies LLC 72,041 0.2 0.2% 8,965 Hedge Fund Total of Top 30 Institutions: 17,299,759 $56.9 40.5% Martin Franklin 8,905,223 $29.3 20.8% Steel Partners Holdings LP 1,571,125 5.2 3.7% Irwin

Simon 1,262,970 4.2 3.0% Albert Manzone 295,737 1.0 0.7% Ira Lamel 190,405 0.6 0.4% Jefferies Jefferies LLC / November 2023 14 Current Stockholder Overview as Presented to the Special Committee on October 16, 2023 NasdaqCM:

FREE Total of Top 5 Insiders: 12,225,460 $40.2 28.6% Source: FactSet; Bloomberg. Account holdings are based on 13F filings(as of 06/30/23 or most recent available). Insider holdings based on Proxy and Form 4 filings.