STOCKHOLDER PROPOSALS AND COMPANY INFORMATION

Stockholder Proposals and Director Nominations

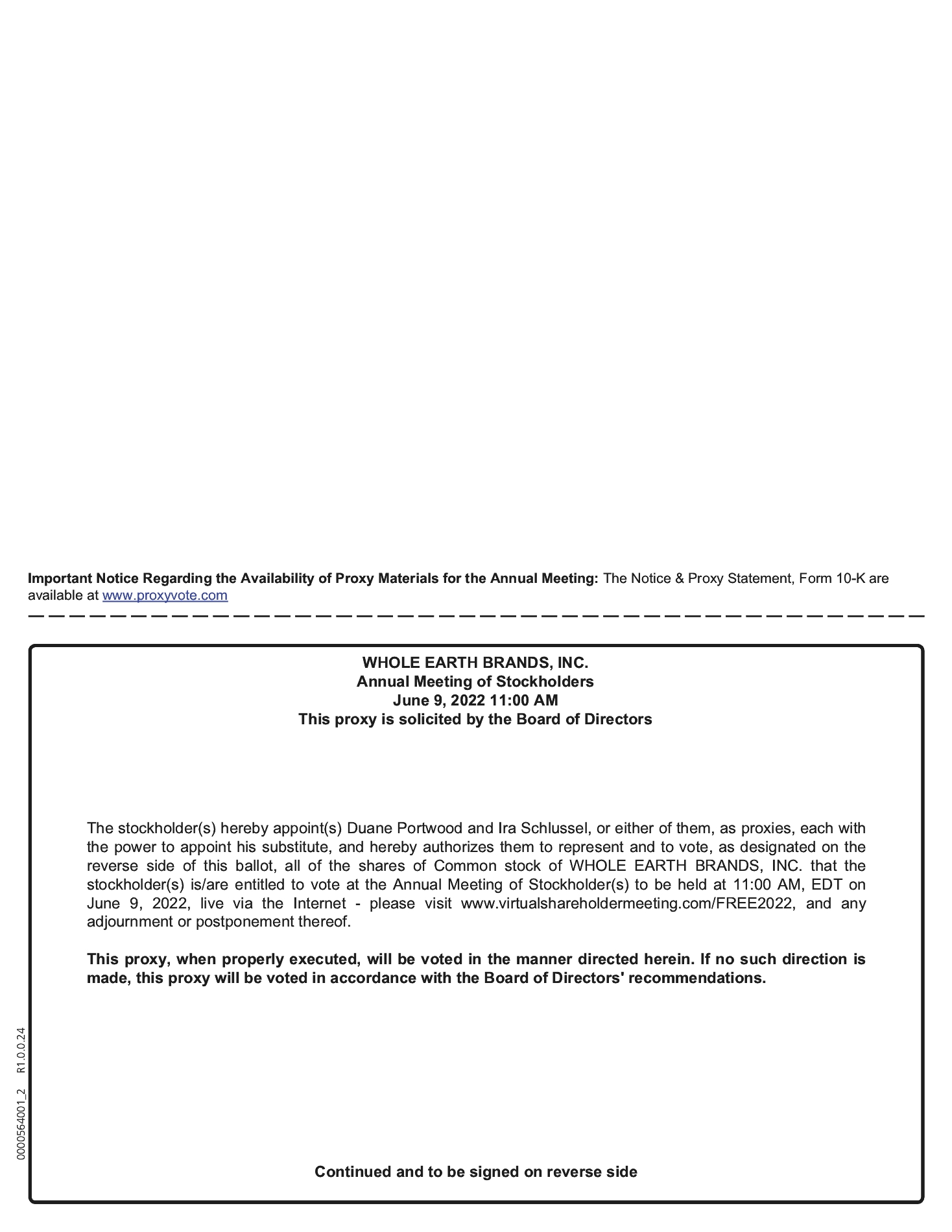

In accordance with Rule 14a-8 under the Exchange Act and the advance notice provisions of our Bylaws, stockholder proposals and director nominations for the 2023 Annual Meeting of Stockholders must be received by our Corporate Secretary at our principal executive office on or before February 9, 2023.

In order for proposals submitted outside of Rule 14a-8 to be considered at the 2023 Annual Meeting of Stockholder, stockholder proposals, including stockholder nominations for directors, must comply with the provisions in the Bylaws. The Bylaws provide that stockholders are required to give advance notice to the Company of any business to be brought by a stockholder before an annual stockholders’ meeting. For business to be properly brought before an annual meeting by a stockholder, the stockholder must give timely written notice thereof to the Secretary of the Company at the principal executive offices of the Company, 125 S. Wacker Drive, Suite 3150, Chicago, Illinois 60606.

In order to be timely, a stockholder’s notice must be delivered not later than the 90th day prior to the first anniversary of the preceding year’s annual meeting of stockholders nor earlier than the 120th day prior to the first anniversary of such date. Therefore, any stockholder proposals, including nominations for directors, submitted outside of Rule 14a-8 to be voted on at the 2023 Annual Meeting must be received by the Company not earlier than February 9, 2023 and not later than March 11, 2023. However, in the event that the date of the 2023 Annual Meeting is advanced or delayed by more than 25 days from the anniversary date of the Annual Meeting, for notice by the stockholder to be timely it must be delivered by the close of business on the tenth (10th) day following the day on which such notice of the date of the 2023 Annual Meeting is mailed or such public disclosure of the date of the 2023 Annual Meeting is made, whichever first occurs. Such proposals and nominations must be made in accordance with, and include the information required to be set forth by, the Bylaws. An untimely or incomplete proposal or nomination may be excluded from consideration at the 2023 Annual Meeting.

Annual Report to Stockholders and Form 10-K

Our 2021 Annual Report to Stockholders, including financial statements for the fiscal year ended December 31, 2021, accompanies this Proxy Statement. The Annual Report is also available on our website at https://investor.wholeearthbrands.com/sec-filings. Copies of our 2021 Annual Report on Form 10-K, which is on file with the SEC, are available free of charge to any stockholder who submits a request in writing to Investor Relations, Whole Earth Brands, Inc., 125 S. Wacker Drive, Suite 3150, Chicago, Illinois 60606, or by calling (312) 840-6000. Copies of any exhibits to the Form 10-K are also available upon written request and payment of a fee covering our reasonable expenses in furnishing the exhibits.

Householding of Proxy Materials

Applicable rules permit us and brokerage firms to send one Notice or Proxy Statement and Annual Report to multiple stockholders who share the same address unless we have received instructions to the contrary from one or more of the stockholders. This practice is known as householding. If you hold your shares through a broker, you may have consented to reducing the number of copies of materials delivered to your address. In the event that you wish to revoke a householding consent you previously provided to a broker, you must contact that broker to revoke your consent. If you (i) are eligible for householding and you currently receive multiple copies of either our Notice or Proxy Statement and our Annual Report but you wish to receive only one copy of each of these documents for your household or (ii) currently receive only one set of these documents due to householding and wish to revoke your consent for future mailings, please contact Broadridge Financial Solutions, Inc. by mail at Householding Department, Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717 or by telephone at (800) 542-1061.

If you are currently subject to householding and wish to receive a separate Proxy Statement or Annual Report, you may find these materials on our website at https://investor.wholeearthbrands.com/sec-filings. You may also request printed copies of our Notice or Proxy Statement and Annual Report free of charge by contacting Investor Relations, Whole Earth Brands, Inc., 125 S. Wacker Drive, Suite 3150, Chicago, Illinois 60606, or by calling (312) 840-6000. We will deliver promptly, upon written or oral request, a separate copy of the Notice, Proxy Statement or Annual Report to a stockholder at a shared address to which a single copy of the documents was delivered.